Will Mortgage Rates Come Down? The Million Dollar Question

Today, let’s dive into the fascinating world of mortgage rates here in Oregon’s wine country. Whether you’re contemplating the idea of downsizing or upsizing your current home, or maybe you’re embarking on the journey of moving and buying a home in our small town region, mortgage rates are a topic you can’t afford to overlook. So, grab your favorite glass of Pinot Noir and lets embark on an informative journey of rates: the past, present, and their possible future.

Compared Historically, How do Current Rates Rate?

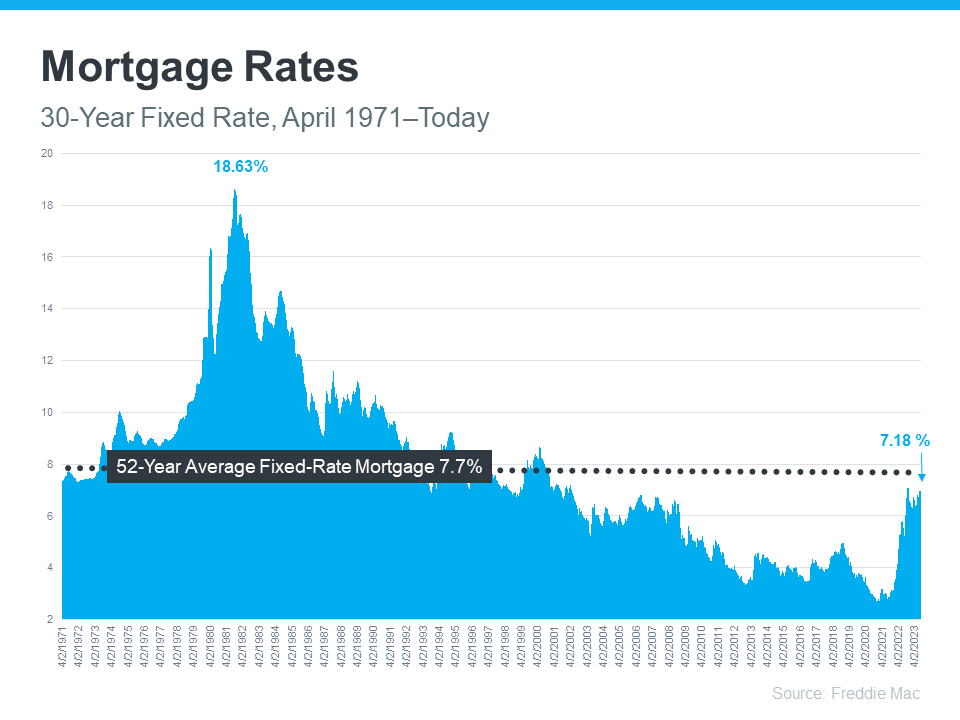

To kick things off let’s look back. Freddie Mac has been diligently tracking the 30-year fixed mortgage rate since April 1971. Every week, they release the results of their Primary Mortgage Market Survey, which averages the mortgage application data from mortgage lenders. This data provides us valuable insights into the historical market trends (see out the graph below).

In looking at the graph, you’ll notice that mortgage rates have experienced a significant uptick since the beginning of 2022. But, and here’s the exciting part, even with this increase, today’s rates remain below the 52-year historical average of 7.7%. This perspective is crucial, especially if you’re considering a change in your homeownership situation, be it downsizing or seeking a larger home.

Many homeowners and buyers here in Yamhill County have grown accustomed to mortgage rates hovering between 3% and 5% over the past 15 years. So, while the recent fluctuations might seem surprising, it’s essential to keep in mind that rates are still within the realm of historical norms.

The Connection Between Inflation and Mortgage Rates

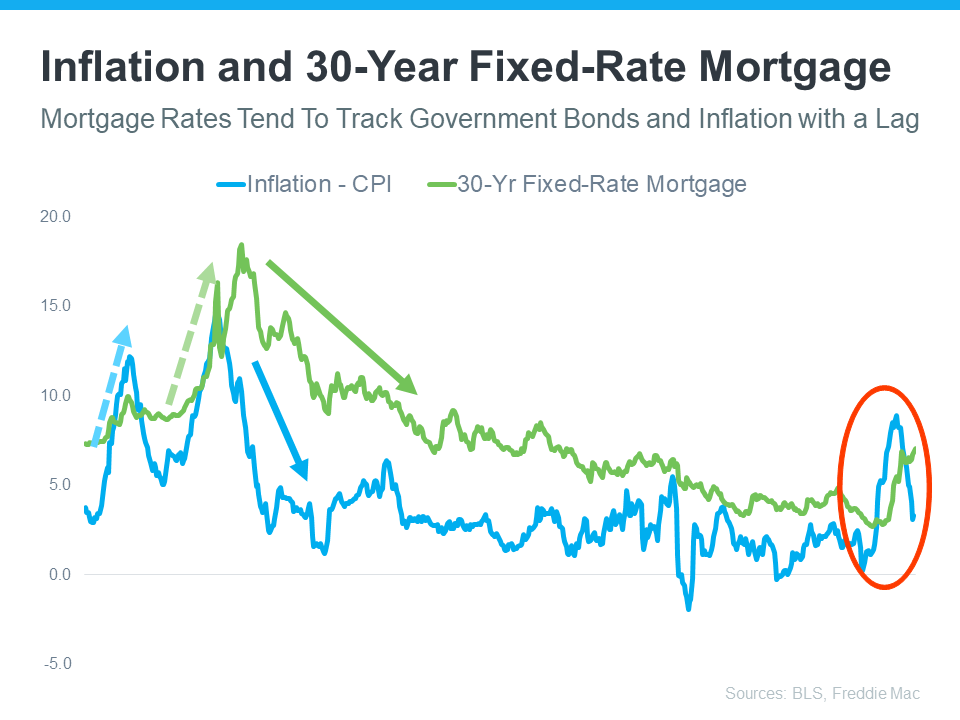

Now, let’s pivot to the intriguing connection between rates and inflation. As we explore the graph below, you’ll notice that there’s a distinct correlation between the two. Consistently, when inflation takes a notable turn (as indicated in blue), mortgage rates tend to follow suit shortly thereafter (as indicated in green).

Now take a close look at the red circled section in the graph – it highlights the recent reduction in inflation. Interestingly, mortgage rates haven’t yet mirrored this decrease to the same extent. This raises a thought-provoking question: Could we be on the cusp of a market correction, with mortgage rates poised to drop and realign with inflation? While we can’t predict the future, history tells us that as inflation moderates, mortgage rates have a tendency to do the same, potentially making homeownership dreams more attainable, because as rates drop, monthly payments become more manageable.

As you Finish Your Glass of Wine, I will summarize

When wondering where mortgage rates may be headed, being able to look at where they’ve been in the past is helpful. The connection between inflation and rates is clear and if that historical relationship continues to hold true, the recent decline in inflation may be good news for the future of our mortgage rates.

Whether you’re pondering the idea of downsizing, upsizing, or buying your first home in the McMinnville and Newberg area, understanding mortgage rates is key. They are in essence, the vital piece of the puzzle that significantly impacts how much home you and if you’re selling, your buyers can afford.

If you’ve been contemplating a move, whether it’s selling, buying, or both, or if you simply have questions about the real estate process here in Yamhill County, don’t hesitate to reach out. I’m here as your friendly guide, and I’d be delighted to assist you on your exciting adventure.

Cheers! 🏠🍇 Feel free to drop me a message anytime; I’m just a click away.