I have had resounding questions from clients in the last few weeks. The questions nearly all center around how the crisis in Ukraine is going to effect our housing economy. In light of the recent events, I realized it was time for a housing market update. How can a war an ocean away, effect the real estate market here at home?

When Russia invaded Ukraine, what everyone had expected to see in the housing market this year, made a turn. Our original housing market update in January anticipated the year to experience: a continued Seller’s market due to low inventory; increased construction growth adding inventory; the raising of interest rates to fight inflation; and a slowing of home price appreciation.

Todays housing market update has a few key players that factor in to determining what most likely lay ahead. Energy, inflation and stocks all effect housing. Each of these factors are in a state of adjustment and as they change, our housing market will as well.

How Energy Effects the Housing Market

As most people know, Russia is both the second largest oil producer and second largest natural gas producer on earth. Europe relies on Russia for nearly 40% of its natural gas and 25% of its oil. BP, Shell and Exxon have severed ties with oil producers in Russia and all experts warn, oil and gas prices will greatly increase. We will see adjustments in our monthly heating bills and at the pump, both.

The effect will be felt in many other areas as well. Oil is a surprising component of production in many goods and supplies that surround our daily lives. Toothpaste, gum, makeup, solar panels, clothing and plastics to name a few, all use petroleum byproducts in production. It is also a component in many building supplies, such as flooring linoleum and carpets. Foam insulation for houses and insulation in refrigerators also use petroleum byproducts in production. The reduction and slowing of producing these goods, will tighten the supply chain.

The transportation of goods will also be effected. As gas prices rise, it will cost more to ship and transport goods. Consumers will feel the increased prices as shipping costs are added to the cost of goods. This can affect new builds in two ways. One, the cost of new construction homes is likely to rise, due to the higher cost of goods. Two, due to slower supply chains things being built may see delays. If builds were to slow, there may be less homes coming on the market than originally expected for the year. Less housing inventory can lead to continued price appreciation of homes. Price appreciation could grow to greater than the original anticipated 5-7%. This being, if the supply of homes doesn’t increase as experts were originally expecting this year.

How Inflation Effects the Housing Market

Another factor to look at is inflation. Last year inflation rose 7% – 7.5%. This is the highest it has been since the early 1980’s. Rising prices could see inflation could get worse. As a buyer, you will want to watch your budget and spending. As costs for goods, gas and rents rise, you may have to adjust what you purchase each month. Adding debt to credit cards or taking money out of savings can affect your purchasing power and ability to purchase.

Experts had previously expected rates to rise multiple times throughout 2022 to tamper down the already high inflation. Since the beginning of the year, we’ve actually seen interest rates on a slow rise due to the 10 year treasury bond fluctuations. The feds are meeting March 15 – 16. The first rate increase was expected to be felt after this meeting, by up to a half a percent. When Russia invaded Ukraine, it threw more uncertainty into the market. The Feds will now not only be looking at how to counteract the current inflation, but balancing how aggressive they can or cannot be. With the threat of greater inflation ahead, they cannot afford to not address the rates. Many experts I follow, say they don’t expect rates to increase more than a quarter percent this first meeting.

Buyers –

As a buyer, you should be aware of the rate your lender has quoted you and the corresponding monthly payment. Also have the conversation with your lender regarding rate increases and how they will affect you. Your monthly payment and possibly your pre-qualification amount could adjust due to rate changes.

Sellers-

As a seller, be aware that as rates rise throughout the year, less buyers may qualify. Higher rates raise monthly payments and some Buyers may no longer be able to purchase. Though the shortage of homes is expected to continue, by year end, there may be less competition for homes. Sellers may see less offers on a home, maybe only 1-4 offers, versus the 5-10-15 plus offers most homes saw in 2021. If you are selling, you will want to recognize what a realistic price for your home sale will look like. This is especially important if you are using equity to put down on a new house. Too, discuss with your lender how the raising of rates will likely affect the monthly payment you qualify for.

How Stocks Effect the Housing Market

Another area that effects the housing market is the stock market. With concerns about inflation, the expected rate increases and the the slowing pace of economic growth, investors have already shown since January that they feel we are in uncertain times. When Russia invaded Ukraine, it confirmed the year of uncertainty. Investors don’t like the unknown, and we will see that as stocks continue to see volatility.

As property is a tangible asset, we may see more buyers coming to the market as money is pulled out of stocks to buy property. In a market with more buyers than we have housing supply, this could make for an even tighter purchasing market. There is a possible offset to this. As the stock market has dropped this year, some buyers that had planned to take money from the stocks, may no longer have their down money saved to the amounts they did a few months ago. Some Buyers may have to hold off buying to rebuild savings for the required money down at closing.

To Summarize…

Updated anticipation overall, we may see interest rates increase at a bit slower pace than originally expected, due to the conflict in Ukraine. The uncertainty could misleadingly have seller’s hesitant to put up their homes for sale in the short term. We could see less than expected new construction homes built. This then leading to shrinking, not growing, inventory. This will keep home prices appreciating and could increase values near the double digits, versus the original thought of 5-7%. We could have new buyers coming to the market if they leave the stock market. With the rise of rates and goods, though, we may have buyers priced out of the market by year end.

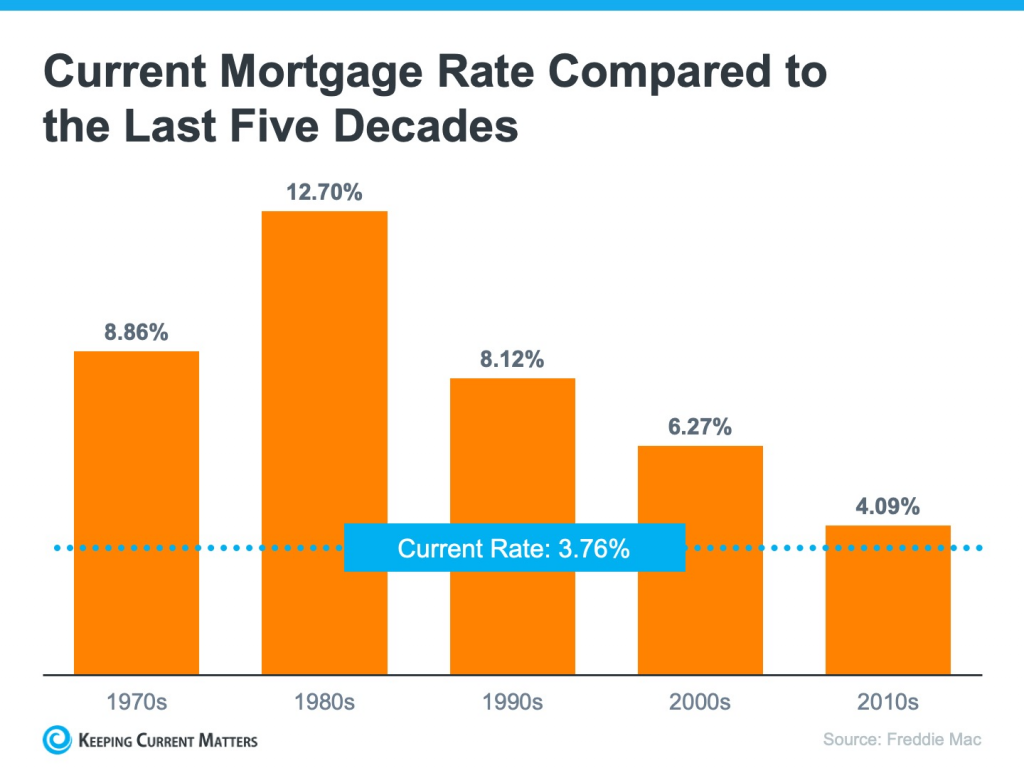

One side note for Buyers to consider. Along with goods and gas, rents are still continuing to rise with no expectations that that will change. Home rates are historically low. Even if rates rise above 4%, buying a house allows you to hedge inflation by locking into a fixed payment for the next 30 years . No longer would yearly rent increases play into your budget.

How do you leverage this housing market update to position yourself for the best success? If you have been planning to buy this year, stay the course don’t edge onto the sidelines. Rates and home prices will rise. The earlier you can purchase in the year, the more money you save over the next 30 years. If you’ve been planning to sell, earlier in the year still appears to the greatest chance of maximizing your investment as inventory still remains so tight. If and when this crisis ends, anyone that’s been on the sideline, buyers and sellers alike, will come back on the market together.