As you may have noticed first hand while shopping at your local home improvement store, lumber costs have skyrocketed this year. Builders too have noticed, as the cost to build homes continue to soar. Why is this happening and what does this mean to the housing industry?

Why Lumber Prices Rose so High

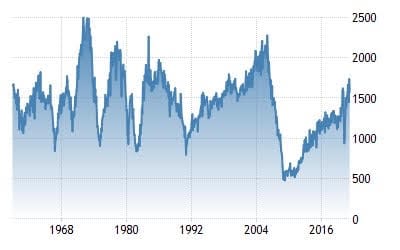

The average home build start from 1960 to 2010 was 1.5 million homes a year. Since the end of the Great Recession of ’07-’09, housing starts have dropped to average only about 1 million homes a year. This has created a compounded shortage of close to 5 million homes. With the slow down of builds, sawmills reduced the production to match demand. Eleven years of reduced staffing, both in the sawmills and the number of drivers previously employed to transport both finished and unfinished wood/lumber to and from the mills, are one of many factors contributing to the lumber shortage and cost increases. When the pandemic hit this last year, people not only began working from home, but began filling their time with home improvement projects. Building decks, adding fences, creating “she-sheds”, and the likes, increased the demand for lumber. With parents and children sharing space at home for work and school, many across the nation started looking for larger homes. Working from home also allowed people to realize their dreams of moving to new locations. Still maintaining their current jobs, the removal of the daily commute opened up options. Millennials, the largest generational group of the US, also entered the housing market. Having saved money, traveled and attended college, they are now ready and buying their first homes. The housing industry boom began.

In the fall of 2020, we saw permit approvals and new home starts increase. This due to both the lack of inventory due from lower build numbers and the influx of buyers on the market. This further increased the demand for lumber. Interest rates dropped to historical lows by the end of 2020 reducing monthly mortgage payments and lead to another spike of qualified buyers. By Jan. 2021 new house builds hit the highest they had been since 2007. Sawmills tried to increase production in re-opening mills that had closed due to the pandemic and hiring staff and truckers for production and transportation. However, the pool of qualified drivers was small from years of low demand, and trucking schools had been shut down, so finding or training new drivers has proven to be a challenge. Mills have begun working to increase production but their location in rural communities makes hiring en mass difficult. Unemployment insurance and bonus payments make staff less willing to go back to work. Even when the mills were able to bring on staff, COVID outbreaks caused new slowdowns in production.

How this will Continue to Affect Housing

All of these factors continue to hamper the increase in lumber supply and continue to drive up costs. Many believe it will be latter 2022 to early 2023 before we see a true leveling of prices due to demand and supply of plywood and lumber re-balancing. It appears the cost of building with therefor be at a high premium.